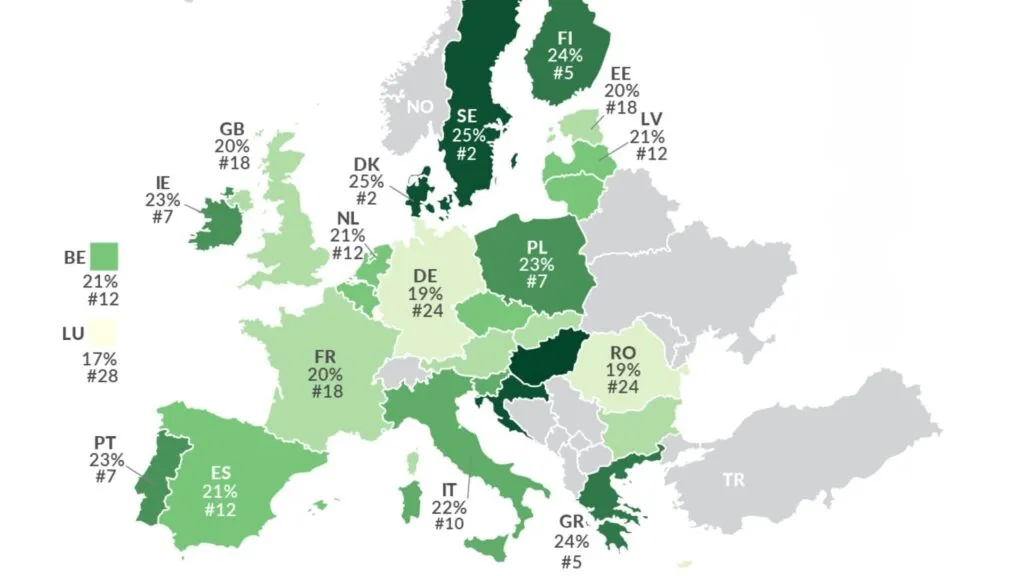

Global VAT Ratio Table – Country-Wise VAT Rates & Reverse VAT Applicability (2025)

Global VAT Ratio table for 2025 with country-wise VAT rates and reverse VAT applicability. This guide helps businesses, freelancers, and financial professionals calculate VAT backwards using accurate tax percentages. Whether you’re working in the UK, UAE, Ireland, South Africa, or beyond, our reverse VAT insights support cross-border invoicing, tax returns, and compliance.

Reverse VAT Tax CalculatorLearn how to remove VAT from gross amounts using standard formulas and stay updated with international VAT trends. Ideal for reverse VAT calculator users, Excel modelers, and tax advisors seeking clarity on global VAT rates. Fast, reliable, and built for international financial accuracy.

Understanding VAT rates across different countries is essential for businesses, freelancers, and financial professionals who deal with international transactions. Whether you’re preparing invoices, calculating reverse VAT, or filing tax returns, knowing the correct VAT ratio helps you stay compliant and accurate.

This page provides a comprehensive overview of standard VAT rates for major countries in 2025, along with notes on reverse VAT applicability. These rates are commonly used in reverse VAT calculations, where users need to remove VAT from a gross amount to find the net value.

What Is a VAT Ratio?

A VAT ratio refers to the percentage of Value Added Tax applied to goods and services in a specific country. It’s used to calculate both forward and reverse VAT. In reverse VAT, the ratio helps determine how much tax was included in a total price, allowing users to extract the net amount.

For example, if the VAT rate is 20%, the reverse VAT formula is:

Net Amount = Gross Amount ÷ (1 + VAT Rate) VAT Amount = Gross Amount − Net Amount

This formula is used globally to calculate VAT backwards, especially in countries where reverse charge VAT is applicable.

Global VAT Ratio Table

Here is a country-wise breakdown of standard VAT rates and whether reverse VAT is commonly applied:

| Country | Standard VAT Rate | Reverse VAT Applicable | Notes |

|---|---|---|---|

| United Kingdom | 20% | Yes | Widely used in B2B and CIS transactions |

| Ireland | 23% | Yes | Applies to digital services and goods |

| South Africa | 15% | Yes | Reverse charge used in imports |

| UAE | 5% | Yes | Flat rate across most goods and services |

| Kenya | 16% | Yes | Used in cross-border services |

| Philippines | 12% | Yes | Applies to VAT-registered entities |

| Pakistan | 17% | Yes | Varies by province and sector |

| France | 20% | Yes | Reverse charge for EU transactions |

| Germany | 19% | Yes | Reverse VAT for intra-EU B2B services |

| Australia | 10% (GST) | Yes | GST reverse charge for imports |

| Canada | 5% (GST) | Yes | GST/HST varies by province |

| India | 18% (GST) | Yes | Reverse charge for services and imports |

| Italy | 22% | Yes | Reverse VAT for EU services |

| Netherlands | 21% | Yes | Common in digital services |

| Saudi Arabia | 15% | Yes | Reverse charge for foreign suppliers |

These VAT ratios are used in reverse VAT calculators to determine the net price from a VAT-inclusive total. For example, if a product costs €123 in Ireland (23% VAT), the net amount is calculated as €123 ÷ 1.23 = €100, and the VAT is €23.

Why Reverse VAT Is Important

Reverse VAT is a method used to shift the responsibility of VAT reporting from the seller to the buyer. It’s common in cross-border transactions, digital services, and industries like construction. By understanding the correct VAT ratio, users can accurately calculate the tax component and ensure proper compliance.

Reverse VAT is especially useful when:

- You only have the gross amount and need to find the net price

- You’re dealing with international suppliers or clients

- You want to automate VAT calculations in Excel or accounting software

- You need to file VAT returns with precise breakdowns

How to Use VAT Ratios in Reverse Calculations

To remove VAT from a price, apply the formula:

Net = Gross ÷ (1 + VAT Rate)

Examples:

- UK (20% VAT): £120 ÷ 1.2 = £100 net

- UAE (5% VAT): AED 105 ÷ 1.05 = AED 100 net

- Ireland (23% VAT): €123 ÷ 1.23 = €100 net

- South Africa (15% VAT): R115 ÷ 1.15 = R100 net

This method is used in reverse VAT calculators worldwide and is essential for accurate financial reporting.

Final Thoughts

This global VAT ratio table is designed to support users who need to calculate reverse VAT across different countries. Whether you’re using a reverse VAT calculator online or building your own Excel model, these rates provide the foundation for accurate and compliant tax calculations.

Always verify local VAT laws for exemptions, reduced rates, and sector-specific rules. For the most reliable results, use updated tools and consult your country’s tax authority when needed.